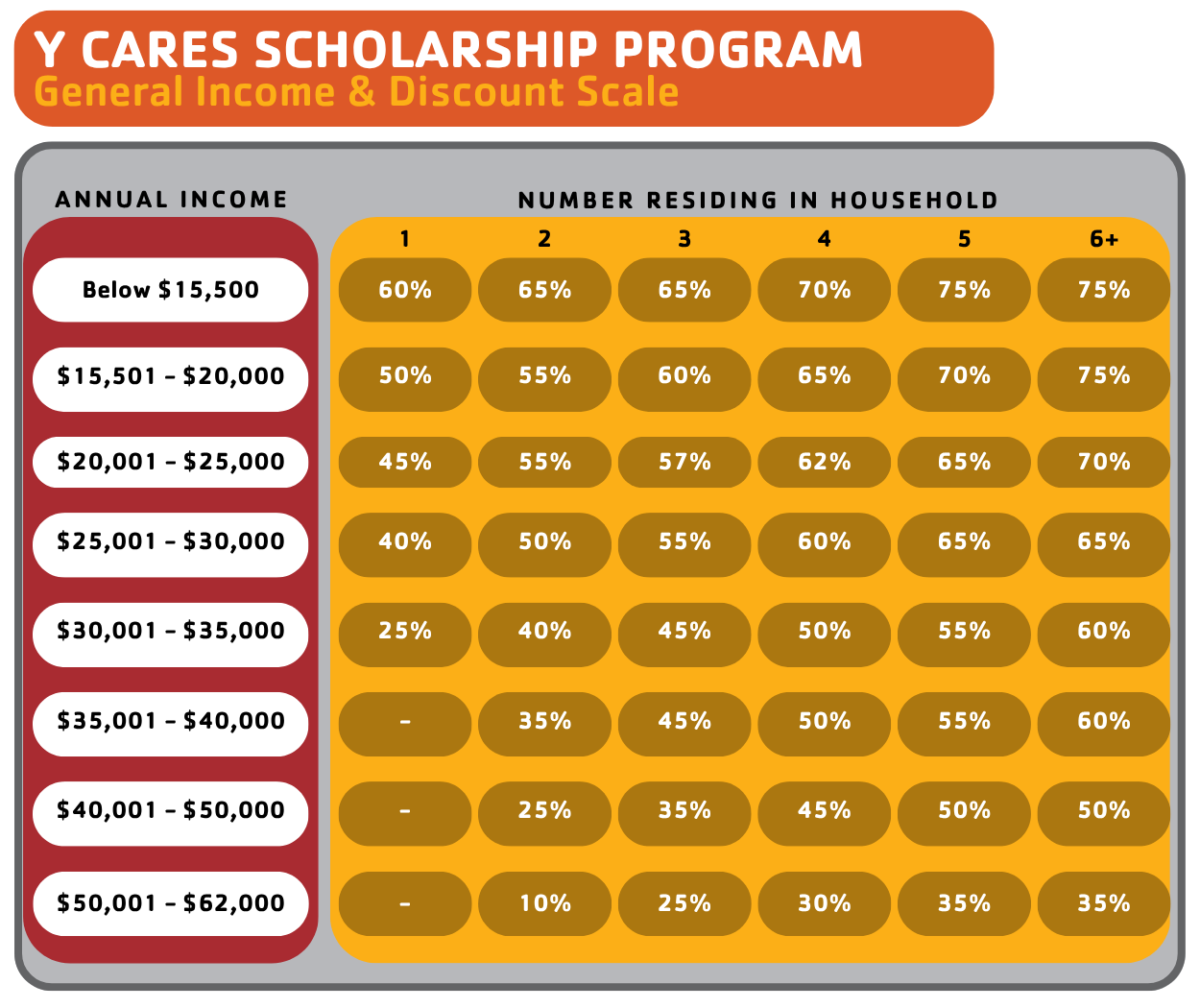

Y Cares: Where Support Meets Access

At Decatur Family YMCA, we believe that everyone—regardless of age, income, or background—deserves the opportunity to grow stronger in spirit, mind, and body. That’s why we offer Y Cares Financial Scholarships, a program designed to ensure that cost is never a barrier to accessing life-changing YMCA programs and services.

Thanks to the generosity of individual donors, community partners, and the support of the United Way, the Y is able to provide financial assistance to individuals and families who qualify. Scholarships can help reduce the cost of membership, youth programs, swim lessons, camps, and more—opening doors for those who need us most.

Please contact Debra Clark at 872-9622 x 129 or debra.clark@decaturymca.org if you have any questions or concerns with our Y Cares scholarship program.

Download the application here: 2025 Y Cares Scholarship Application

YCARES SCHOLARSHIP – INCOME VERIFICATION GUIDELINES

Income must be provided for each adult on the membership; children may be counted as dependents until age 24, but the parent/guardian must maintain proof of dependency.

INCOME AND DEPENDENT VERIFICATION

Provide a copy of the most recent federal tax return document OR Department of Human Services (DHS) award letter that indicates gross earned income and proof of dependents.

AND

Provide verification on all applicable sources of income and provide documentation for any other assistance you receive:

-

2 Pay Stubs for each working adult that are current and consecutive

-

Pensions or Retirement

-

Bank statements that show income source

-

Social Security Income (SSI) or Social Security Disability Income (SSDI)

-

Unemployment Statement

-

Cash benefit Government Assitance: TANF, grants, FIP

-

Child Support Income & Alimony payments/deductions

-

Student loan living expense portion

If there is not current income verification, zero income, negative income, or not approved documentation of income, a financial assistance award cannot be processed.

PROOF OF DEPENDENT(S)

Provide a minimum of 1 document of dependent verification:

-

Dependents claimed on the approved 1040 federal tax return documents

-

Social Security Income (SSI) or Social Security Disability Income (SSDI): benefit will be addressed to the parent but the child’s name will be listed on the same document

-

Government Assistance Documentation Listing Household Size

-

Report card from school with parent or guardian and child’s name present

-

Custody Agreement legal documentation

-

Dependents between the ages of 18 and 23 must provide a college schedule verifying enrollment in at least 12 credit hours